Breathtaking Tips About How To Improve Quick Ratio

Analyze your short term liabilities to make sure that the debt you’re incurring is justified.

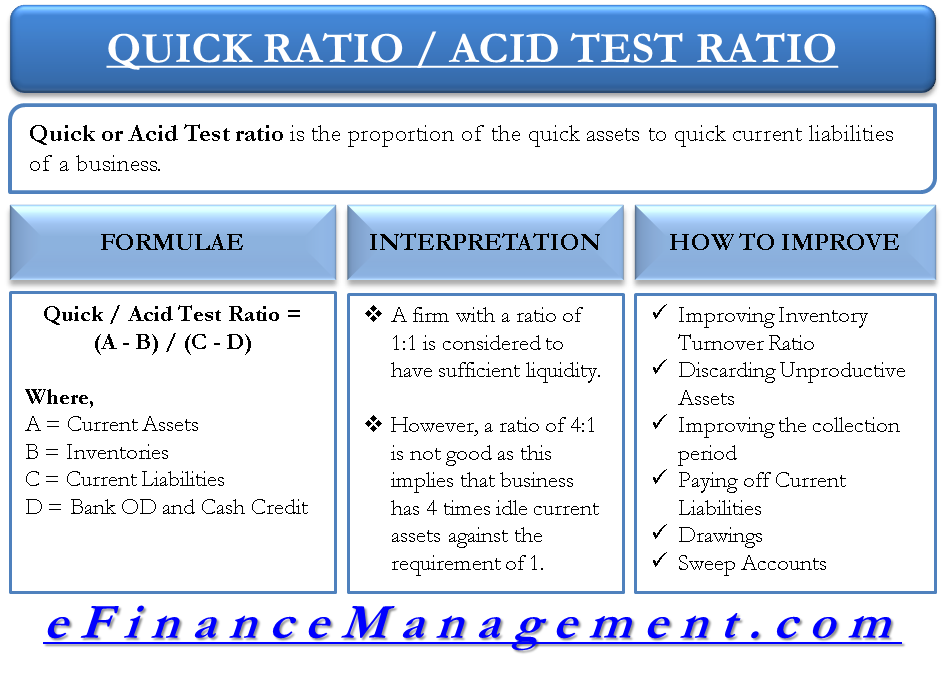

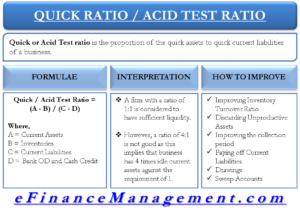

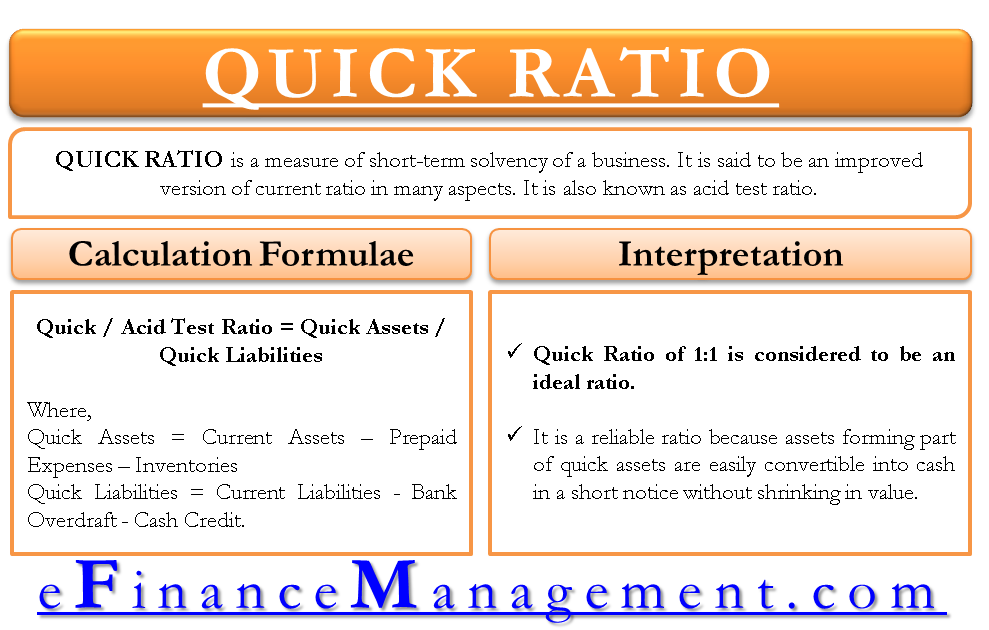

How to improve quick ratio. Higher inventory turnover (greater sales) will mean that the inventory that cannot be taken into account while computing quick ratio may turn into cash more quickly,. If you’re wondering how to improve quick ratio, boosting your current ratio will put you on the right path. The best possible way to improve the quick ratio is to improve quick assets.

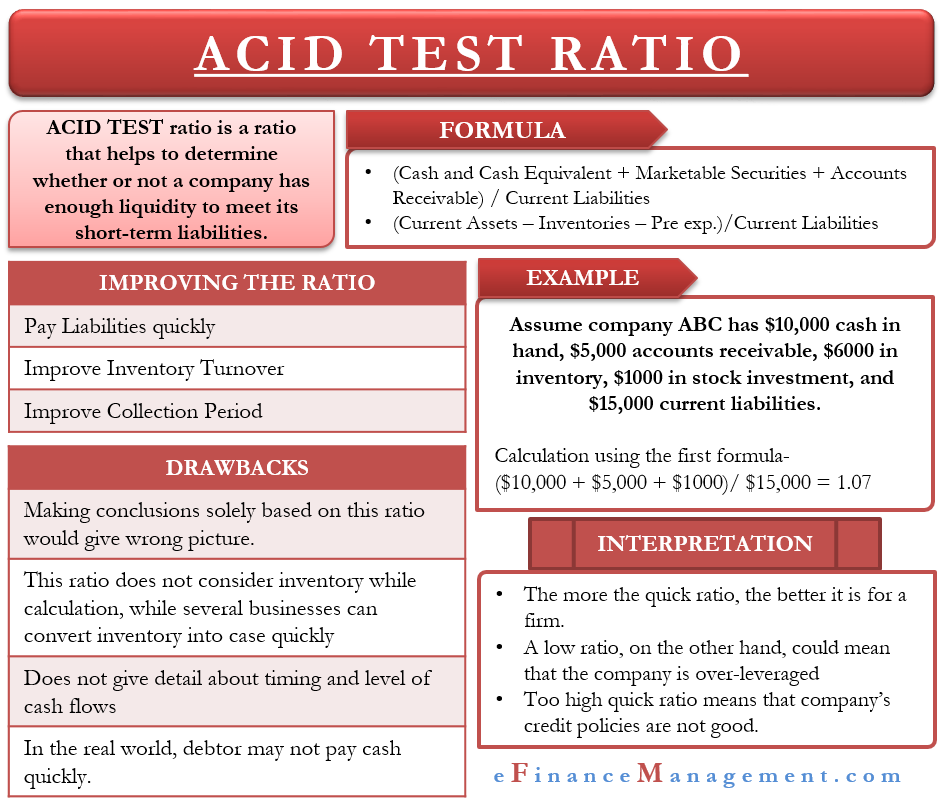

Current ratio and when you best use each metric in your business, plus where the acid test ratio fits in. There are a few ways to improve your quick ratio. Carefully evaluating your marketing and sales.

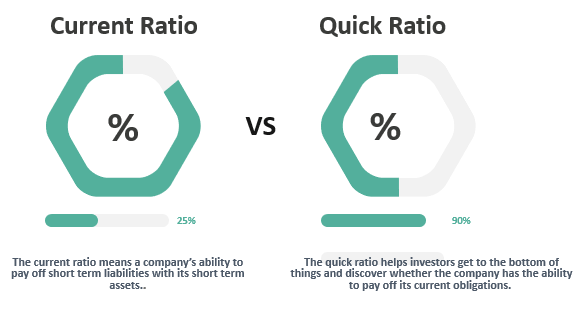

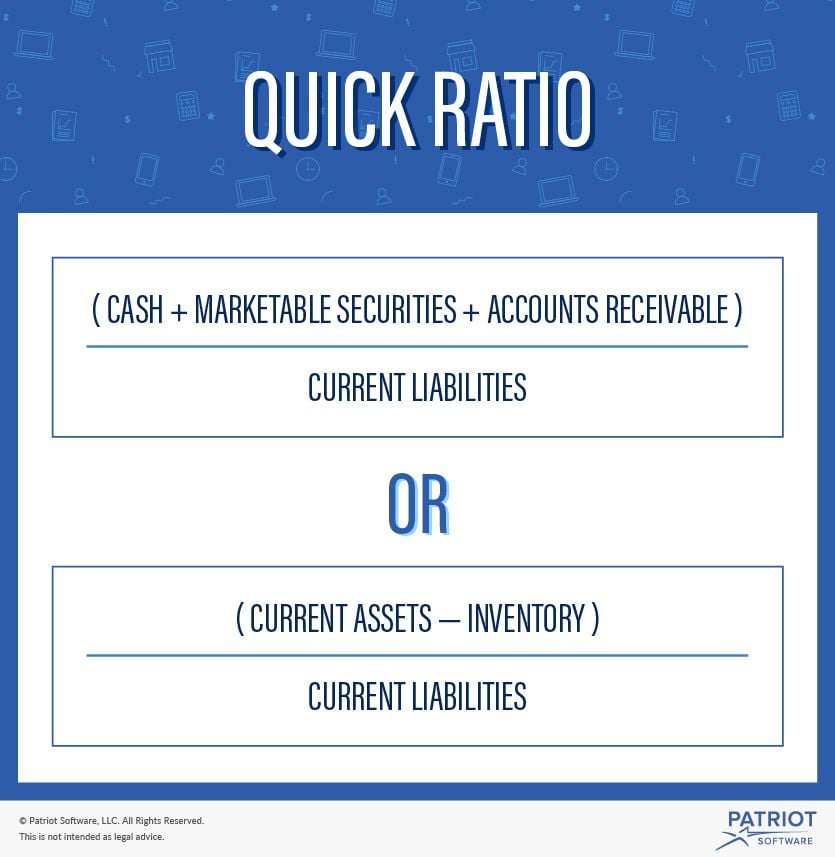

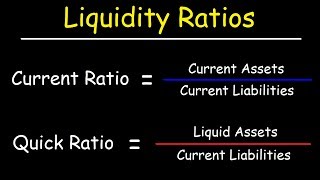

Learn the quick difference between the quick vs. The cash items include hard cash and. This is primarily stalking from the fact that such small business holders or retailers can negotiate in long credit periods with contractors or suppliers while offering little.

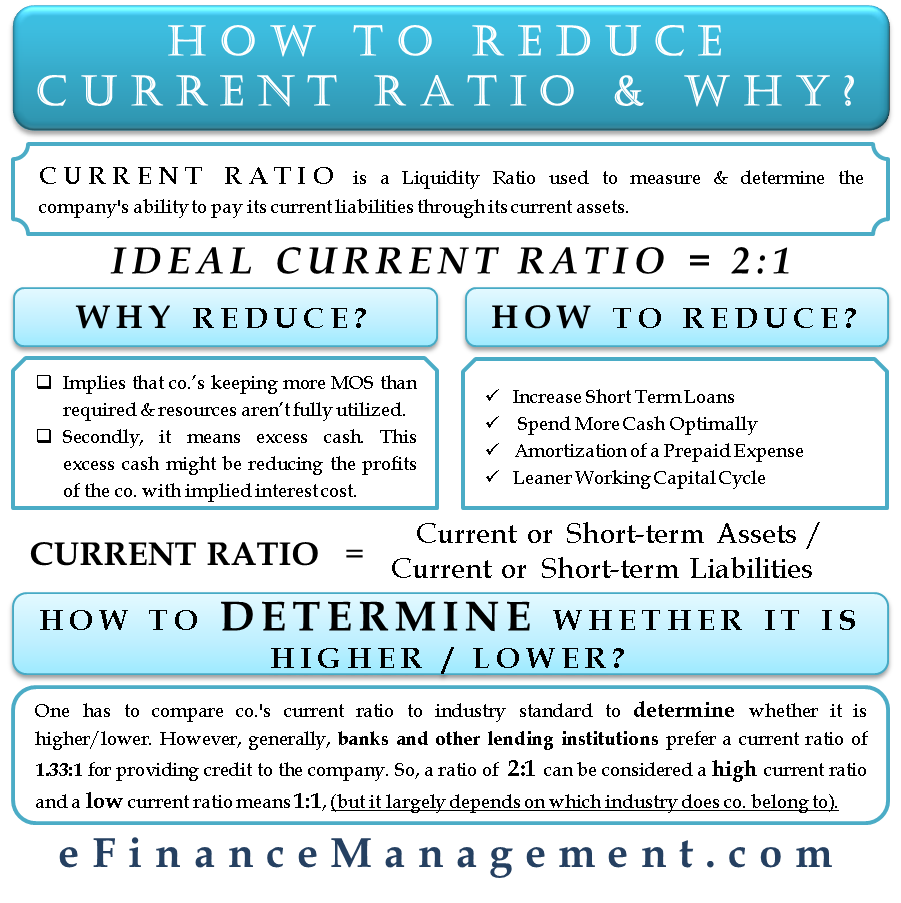

Ways in which a company can increase its liquidity ratios include paying off liabilities, using. Improving your company’s current ratio the ideal current ratio varies by. There are a few ways to improve your quick ratio.

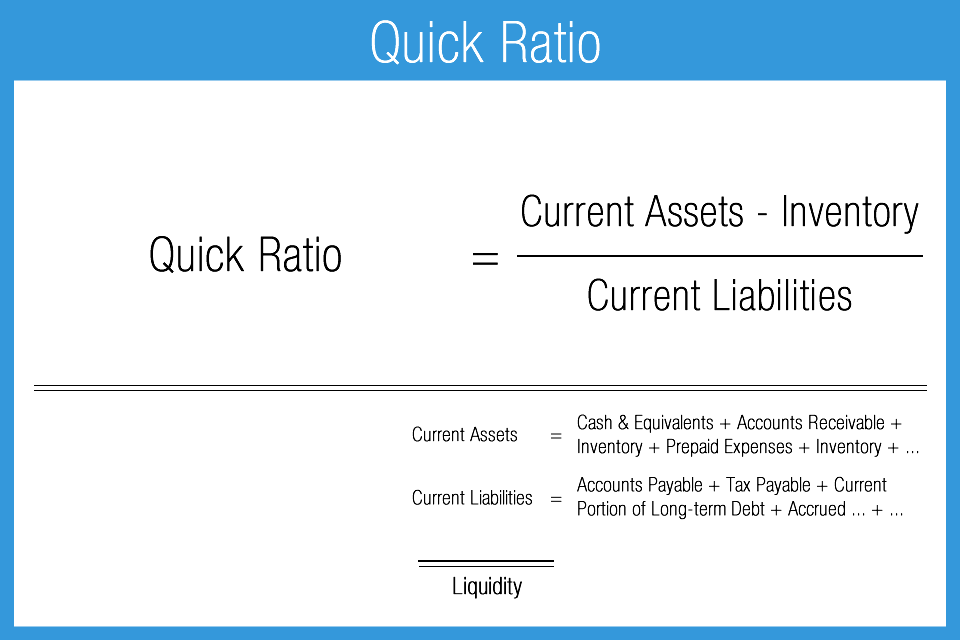

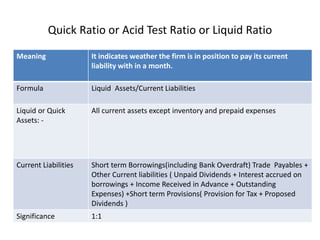

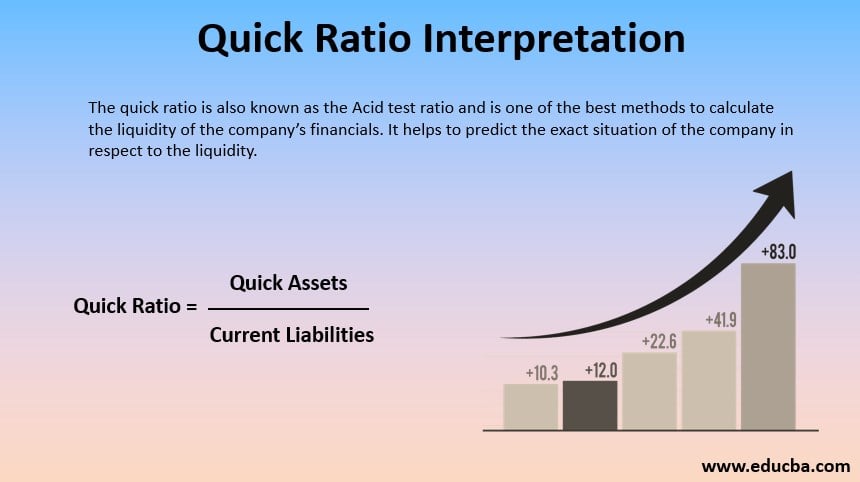

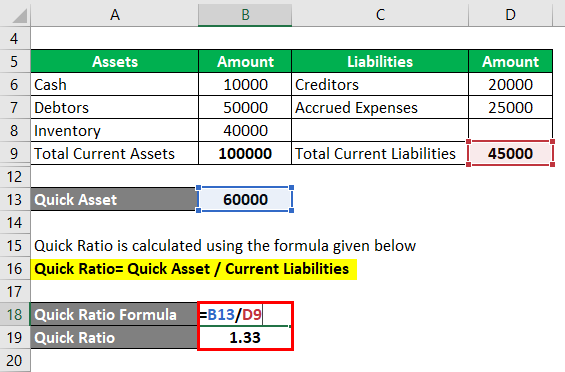

A business should maintain an adequate level of cash at any given time. Two of the most common liquidity ratios are the current ratio and the quick ratio. Remember, while you want to include current assets in your quick ratio, you only want to include liquid assets.

To improve the quick ratio, a company can increase its sales and inventory turnover, work on its invoice collection period and pay off liabilities at the earliest. To improve your financial ratios related to liquidity, you should take a number of steps: The test measures a company’s ability to pay back its accounts payable with quick assets that may readily convert to cash.

/terms-q-quickratio-final-52ee5110fc81457591d8108913ee6250.png)

/dotdash_Final_How_Is_the_Acid-Test_Ratio_Calculated_2020-01-e78bcddeb1dc41d29bcacaa0072bc773.jpg)